Anuncios destacados

LENDER FOR BUYING HOME

Contacte al anunciante

If you're in the market to buy a home, you may have heard about "zero down" home loans. Or Down Payment Assistance products (DPA). They are very useful and popular for First Time Buyers. These types of loans allow you to purchase a home without making a down payment, which can be an attractive option for many buyers who don't have significant savings or want to keep their money invested elsewhere. But is a zero down home loan the right choice for you? Let's explore this topic in more detail.

First, it's important to understand that zero down home loans are not available to everyone. Generally, these types of loans are only available to borrowers with good credit scores and stable incomes. In addition, some lenders may require that you have a certain amount of cash reserves or a strong credit history in order to qualify.

If you do qualify for a zero down home loan, there are some potential benefits. For one, you won't need to come up with a large down payment upfront, which can be a significant barrier to homeownership for many people. You'll also have more cash on hand for other expenses, such as home repairs, moving costs, or furnishing your new home.

Ultimately, whether a zero down home loan is right for you depends on your individual financial situation and goals. If you have good credit, stable income, and limited savings, it may be worth considering. But if you can afford to make a down payment, doing so can save you money over the long term and give you more flexibility when it comes to choosing a home.

As always, it's important to do your research and work with a trusted lender to determine the best home loan options for your needs. With careful planning and consideration, you can find the right path to homeownership that fits your budget and lifestyle.

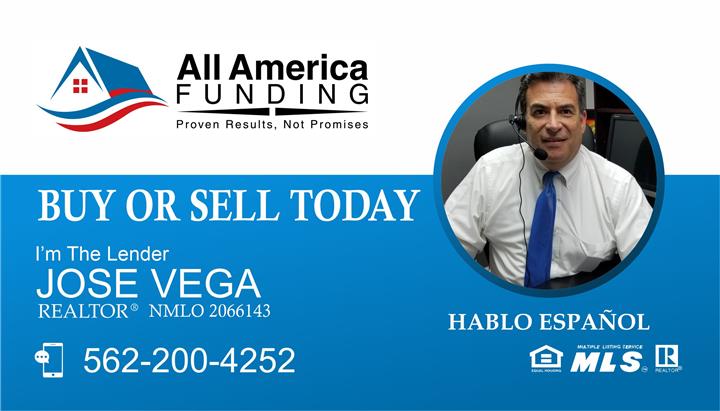

Jose Vega (562)200-4252 "El senor de las casas y prestamos"#casas #realestate #prestamosdecasa #calificarparacompra

#refinanciar # reversemortgage #agentederealestate #casadeventalosangeles #casasbaratas #casasdegobierno #casashud #casasensanbernardino #casasenriverside #duplexenventa #dondeesmasbaratocomprar #downpaymentassistance #cerodown #excellencerealestate #interesebajos #bajarelpagodecasa #selfemployedprestamos #ventadecasas #reversemortgage #seniors #homeloans #comprarcasa #downpaymentassistance #realestate #calificarparacomprar #selfemployedloans

#vendermicasa #agentederealestatelosangeles #itincompradore #primeroscompradores #firsttimebuyers #raulluna #juliareynoso Prestamos para self employed,prestamos de cero enganche VERIFICACION DE EMPLEO LOANS ect. Hay mucha variedad para que compre su casa. Buen credito,mal credito, todo tiene arreglo mientras que usted tenga ganas#raulluna #juliareynoso #abeltejeda #themortgageguys #elclasificado

Area: San Bernardino ›

Categoría: Servicios Profesionales ›

Subcategoría: Planificación Financiera ›

If you're in the market to buy a home, you may have heard about "zero down" home loans. Or Down Payment Assistance products (DPA). They are very useful and popular for First Time Buyers. These types of loans allow you to purchase a home without making a down payment, which can be an attractive option for many buyers who don't have significant savings or want to keep their money invested elsewhere. But is a zero down home loan the right choice for you? Let's explore this topic in more detail.

First, it's important to understand that zero down home loans are not available to everyone. Generally, these types of loans are only available to borrowers with good credit scores and stable incomes. In addition, some lenders may require that you have a certain amount of cash reserves or a strong credit history in order to qualify.

If you do qualify for a zero down home loan, there are some potential benefits. For one, you won't need to come up with a large down payment upfront, which can be a significant barrier to homeownership for many people. You'll also have more cash on hand for other expenses, such as home repairs, moving costs, or furnishing your new home.

Ultimately, whether a zero down home loan is right for you depends on your individual financial situation and goals. If you have good credit, stable income, and limited savings, it may be worth considering. But if you can afford to make a down payment, doing so can save you money over the long term and give you more flexibility when it comes to choosing a home.

As always, it's important to do your research and work with a trusted lender to determine the best home loan options for your needs. With careful planning and consideration, you can find the right path to homeownership that fits your budget and lifestyle.

Jose Vega (562)200-4252 "El senor de las casas y prestamos"#casas #realestate #prestamosdecasa #calificarparacompra

#refinanciar # reversemortgage #agentederealestate #casadeventalosangeles #casasbaratas #casasdegobierno #casashud #casasensanbernardino #casasenriverside #duplexenventa #dondeesmasbaratocomprar #downpaymentassistance #cerodown #excellencerealestate #interesebajos #bajarelpagodecasa #selfemployedprestamos #ventadecasas #reversemortgage #seniors #homeloans #comprarcasa #downpaymentassistance #realestate #calificarparacomprar #selfemployedloans

#vendermicasa #agentederealestatelosangeles #itincompradore #primeroscompradores #firsttimebuyers #raulluna #juliareynoso Prestamos para self employed,prestamos de cero enganche VERIFICACION DE EMPLEO LOANS ect. Hay mucha variedad para que compre su casa. Buen credito,mal credito, todo tiene arreglo mientras que usted tenga ganas#raulluna #juliareynoso #abeltejeda #themortgageguys #elclasificado

Area: San Bernardino ›

Categoría: Servicios Profesionales ›

Subcategoría: Planificación Financiera ›

Contacte al anunciante

Anuncios similares

Que hacer con su forebearance

I'm a licensed professional who helps clients buy, sell, and rent properties such as homes, apartments, and commercial buildings. A realtor

Como sacar dinero de su casa

Hay varias razones por las cuales podría ser necesario refinanciar un préstamo de casa: En general, refinanciar su préstamo de casa puede a

Programa Nuevo ITIN 3.5% Down

JOSE VEGA 562-200-4252 bre 01114731 Si se puede lo que digo, Programa nuevo. Compre con ITIN con 3.5% de enganche. Prestamos para self empl

COMPRAR CON ITIN 3.5% ENGANCHE

JOSE VEGA 562-200-4252 Con el nuevo programa de ITIN, ASEGURESEN QUE SE PUEDE COMPRAR CASA CON 3.5 % DE ENGANCHE. Nomas excisten en pocos b

Anuncios similares

Que hacer con su forebearance

I'm a licensed professional who helps clients buy, sell, and rent properties such as homes, apartments, and commercial buildings. A realtor

Como sacar dinero de su casa

Hay varias razones por las cuales podría ser necesario refinanciar un préstamo de casa: En general, refinanciar su préstamo de casa puede a

Programa Nuevo ITIN 3.5% Down

JOSE VEGA 562-200-4252 bre 01114731 Si se puede lo que digo, Programa nuevo. Compre con ITIN con 3.5% de enganche. Prestamos para self empl

COMPRAR CON ITIN 3.5% ENGANCHE

JOSE VEGA 562-200-4252 Con el nuevo programa de ITIN, ASEGURESEN QUE SE PUEDE COMPRAR CASA CON 3.5 % DE ENGANCHE. Nomas excisten en pocos b

Anuncios destacados